Living Benefits Protect You, Your Family, and Your Wallet

Life insurance has changed recently, and it’s for the best. In certain situations, you can access your death benefit while you’re alive. You read that right — if you have a qualifying illness, some of your benefit amount can be provided to you, so you can use the money while you’re still living! This policy feature is known as a “Living Benefit.”

Important: The cost, benefits, qualifying event, and exclusions may vary by company.

Are Living Benefits Included in Every Policy?

Some insurance companies offer living benefits riders for an additional cost, while others automatically include them in the policy.

We work with companies that do NOT charge extra fees for their living benefits policies, which are included for no extra charge with their term, UL, or whole life products.

Sometimes companies charge administrative fees. However, there’s no federal tax on living benefits, and the rider is very useful if you’re faced with a chronic, critical, or terminal illness or become permanently disabled.

Most Common Types of Living Benefits

Here are the 3 most common types of living benefits and the qualifying events:

1. Chronic Illness

A chronic illness is one that you can’t recover from, and you’re unable to perform 2 of the 6 activities of daily living (ADLs) or have a cognitive impairment like Alzheimer’s or dementia.

The six ADLs are generally defined as bathing, dressing, eating, transferring (walking from a bed to a wheelchair), toileting, and continence (bladder control). If you’re unable to do at least 2 of these 6 activities on your own, you may qualify to use your life insurance living benefit.

Most companies will advance up to 2% of the death benefit per month for 4 years. This amount can provide your family with good money and peace of mind. For example, a $200,000 death benefit policy would provide around $4,000 per month in chronic illness benefits.

2. Critical Illness

Say you’re not chronically ill, but you develop an acute illness, like:

- Stroke

- Cancer

- Heart Attack

- Benign Brain Tumor

- Major Organ Transplant

- End-Stage Renal Failure

- Heart Valve Replacement

- Blindness due to Diabetes

- Invasive Metastatic Cancer

- Coronary Artery Bypass Graft Surgery

If one of these situations occurs, you may be able to access your death benefit. Some carriers will accelerate your death benefit up to 90%.

3. Terminal Illness

If an individual has a terminal illness, they typically have less than two years left. In this case, you could get up to 90% — or even 100% — of your death benefit while you’re still living.

Note: The net amount received may vary based on the insurance company’s policy and contract terms.

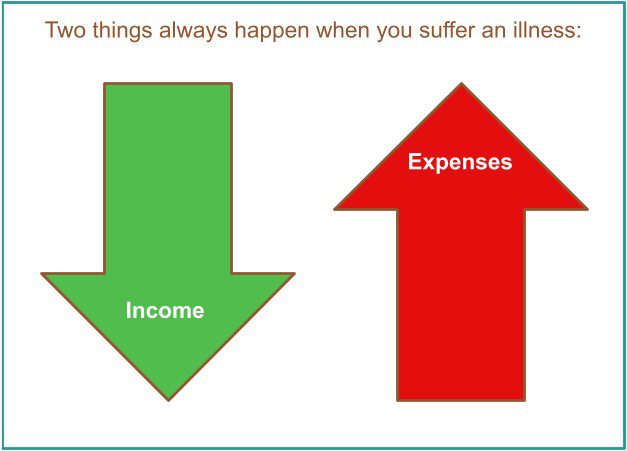

When your expenses become higher than your income, debt starts to pile up. Debt can lead to bankruptcy, unwanted stress, and intense anxiety. Living benefits can help you replace your income and pay those added costs.

What to Consider Before You Commit

Before getting life insurance with living benefits, consider the following variables:

- Policy terms

- Current health

- Occupation risks

- Existing coverage

- Future constraints

- Family health history

How Much Can You Get in Advance?

You’ll want to check your policy to see how much the life insurance company will payout. A living benefits rider will generally pay you somewhere between 24% and 100% of the policy’s total death benefit. However, a lot of these also involve a fixed dollar limit.

For example, let’s assume your policy lets you take 50% in an accelerated death benefit. In that case, your family will still receive the remaining 50% when you die. After you use the living benefit, the insurance company should revise your policy to show the remaining death benefit.

Then, the updated policy stays in force until you pass away — as long as you continue to pay premiums. Your premiums will be adjusted to fit the new death benefit amount.

The Bottom Line

Each company and policy has its own qualifying events and payout factors for living benefits. Let us help. An agent at JMJ Insurance Solutions can explore your options with you and determine the coverage that’s best for you and your family.

When in doubt, remember that three main things can trigger living benefits, and each will let you accelerate money from your policy while you’re still alive and kicking.

If you’d like help in deciding whether taking a living benefit is in the best interest of your loved ones, call the number on your screen today.